Dynamic Pricing and Inflation Management: How AI Helps Retailers Navigate Volatile Markets

- mamta Devi

- Apr 29, 2025

- 3 min read

Written By: Gargi Sarma

One of the biggest issues facing businesses worldwide today is inflation. Global inflation hit 8.7% in 2022, according to the IMF, and although it is predicted to decline, supply chain limitations, geopolitical unrest, and shifting consumer demand trends are all contributing factors to pricing volatility. Traditional pricing tactics are no longer enough in this dynamic context. Companies need to switch to AI-driven, dynamic pricing models that enable them to make quick and wise adjustments.

The New Reality: Pricing in Volatile, Inflationary Markets

Input costs have increased: CPG manufacturers estimated an average 12–20% increase in transportation and raw material costs in 2022, according to McKinsey.

Consumer behavior is changing. According to NielsenIQ data from 2023, 43% of consumers worldwide have moved to less expensive brands, and 58% are actively looking for sales.

Both costs and price sensitivity are increasing. Brands and retailers must choose between keeping customers and preserving profitability.

What Truly Makes Pricing "Dynamic"?

A. Inputs

Real-time cost data (e.g., raw material, freight, energy)

Competitive pricing scraped from digital channels

Inventory pressure (e.g., short shelf life, stock aging)

Consumer behavior signals from POS, loyalty apps, and social media

Macroeconomic shifts: exchange rates, inflation indices, policy changes

B. Outputs

Regionally-adjusted base prices

Event- and season-aware pricing (Diwali, Black Friday, Eid, etc.)

Elasticity-informed promotions

Automated alerts on pricing inefficiencies

Managing Price Elasticity with AI

Price elasticity quantifies the degree to which price affects demand. It is crucial to comprehend flexibility across regions and client segments in an inflationary market.

Elasticity Modeling: AI algorithms determine how customers react to pricing adjustments after being trained on previous sales, promotion, and competitor data. For example, the elasticity is -0.5 if a 10% price rise results in a 5% decrease in sales.

Elasticity in Segments: Micro-elasticity models by product, channel, and region can be produced by AI. Because of brand loyalty, a high-end snack can be elastic in metropolitan Brazil but inelastic non Mexico City.

Simulation of Scenarios: AI-powered systems forecast revenue and margin results by simulating price possibilities. Businesses who used pricing simulation tools reported margin improvements of 2–5%, according to Deloitte.

Instantaneous Reaction: AI models advocate pricing modifications by continuously ingesting fresh data, such as inflation indexes and rival price changes.

Figure 1: Managing Price Elasticity with AI

Insights: According to a BCG study, when prices were in line with real-time demand signals, retailers adopting AI for pricing achieved revenue growth of up to 5% and margin uplift of up to 10%.

Localized Pricing in a Globalized Yet Fragmented World

Different regions have different rates of inflation. Localized pricing strategies are essential for CPGs and international merchants.

Factors Influencing Regional Price Strategies:

Figure 2: Trade Intensity

Figure 3: Goods trade relationships (Source: McKinsey)

Example:

A multinational beverage company may require:

Greater costs in areas with poor elasticity (such as the Gulf countries)

In price-sensitive regions (like Argentina and India), bundling or discounting

localized marketing campaigns according to local holidays or meteorological circumstances

AI pricing systems that are localized can absorb:

Data on local costs

SKU prices of competitors (scraped off online shelves)

Indicators of the regional economy

This preserves brand integrity while enabling brands to establish context-aware pricing.

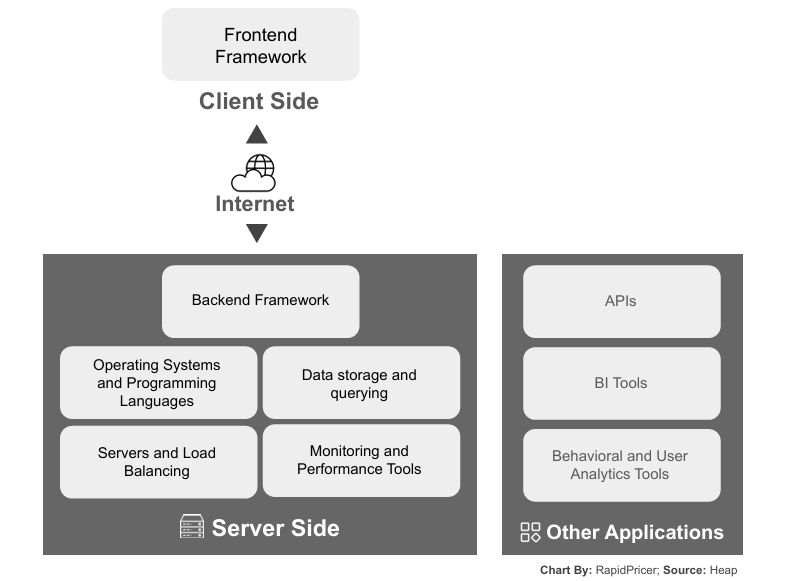

Tech Stack: Tools Powering Modern Pricing

Modern dynamic pricing engines include:

Figure 4: TechStack

Notable Platforms:

RASPER by RapidPricer: Real-time AI-based price and promotion recommendations based on 12 weeks of data.

Impact Analytics: Provides markdown optimization and pricing based on elasticity.

Revionics: Retail science-based pricing is the main focus of Revionics.

Outcomes: What Retailers are Achieving

When employing AI-based dynamic pricing, sales increase can range from 5% to 15% (McKinsey, 2023)

Stockouts are reduced by 10–25% when pricing corresponds with local demand indicators.

20% greater profit on promotional events: AI-powered markdown timing optimization

Conclusion:

Inflation is now a constant force rather than a transient shock. Companies will be more successful if they adjust their prices in response to real-time data, geographical elasticity, and insights from artificial intelligence.

Dynamic pricing is a competitive tool as well as a cost-control measure. In an uncertain world, it helps brands and merchants maintain margins, keep ahead of inflation, and gain the trust of consumers when paired with localization and smart forecasting.

Read More On

The Changing Role of Brands: Building Trust and Loyalty in Retail

The Rise of Retail Media Networks: Transforming the Future of Advertising

Unified Retail Experiences: Beyond Omnichannel to True Integration

Hyperlocal Inventory and Pricing Management: A Solution for Small Retailers

What If Stores Had No Prices? Exploring AI-Driven Pay-What-You-Want Models

About RapidPricer

RapidPricer helps automate pricing and promotions for retailers. The company has capabilities in retail pricing, artificial intelligence, and deep learning to compute merchandising actions for real-time execution in a retail environment.

Contact info:

Website: https://www.rapidpricer.com/

Email: info@rapidpricer.nl

Comments