From Static Lists to Algorithmic Pricing — Why Old Models Are Fading

- mamta Devi

- 52 minutes ago

- 6 min read

Written By: Gargi Sarma

Retail pricing has entered a new era. The old playbook — cost-plus, fixed price lists, or rigid promotional calendars — once delivered predictable margins and simple operations. Today’s operating environment (volatile input costs, fragmented competition, empowered shoppers, and real-time digital channels) rewards agility. Algorithmic or dynamic pricing, powered by data and automated decision loops, is rapidly becoming the more effective approach. Below I contrast the two approaches, explain why static pricing is brittle in 2025, show how algorithms win (with real examples), and outline a practical migration path — how a platform like RapidPricer can take a retailer from static to smart, stage by stage.

What do we mean by the terms

Static Pricing (Cost-Plus/Fixed Lists/EDLP)

Cost-plus: set a price by adding a fixed margin on top of unit cost. Simple, transparent, easy to operate but slow to react when costs move.

Fixed price lists: catalogue prices updated on a schedule (weekly/monthly/seasonally). This centralizes control but leaves retailers exposed between updates.

Everyday Low Price (EDLP): promise consistently low prices (no frequent sales) to reduce promotional complexity and build loyalty — widely known from large discount retailers. Wikipedia

Algorithmic/Dynamic Pricing

Automated price-setting that adjusts prices based on input signals: demand, competitor prices, inventory levels, time, customer segments, and supply-chain costs. Algorithms can run simple rule engines, statistical demand models, or advanced machine learning. Dynamic pricing is a family of techniques sometimes called surge pricing, time-based pricing or variable pricing. Wikipedia

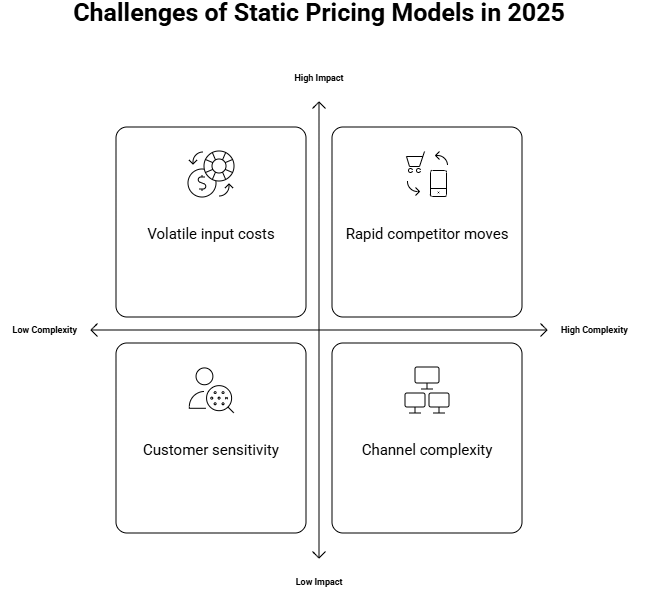

Figure 1: Challenges of Static Pricing Models in 2025

Why Static Models are Increasingly Fragile (The 2025 Reality)

Volatile input costs and supply shocks. Commodities and logistics costs have shown large swings in recent years; when raw costs can jump or fall quickly, fixed margins either erode profitability or create sudden consumer price shocks. Retailers that wait weeks to change list prices absorb losses or lose competitiveness. Recent industry reporting and analysis emphasize how 2024–2025 volatility forced faster pricing responses across categories. McKinsey & Company

Rapid competitor moves and price transparency. Online marketplaces, comparison shopping apps, and competitor experiments make price divergence visible in real time. Static lists can leave a store systematically overpriced (lost sales) or underpriced (left money on the table) relative to peers. Dynamic approaches let retailers react to competitor actions with defined guardrails. Vendavo

Customer sensitivity and segment variation. Consumers vary—“cherry-pickers” chase promotions while “expected price” shoppers value consistency. Static single-price strategies cannot simultaneously satisfy differing segments across channels. Dynamic personalization can present prices/offers tuned to behavior and channel without dismantling an EDLP backbone for other segments. Wikipedia

Channel complexity (store + online + digital menus). Digital menu boards, electronic shelf labels (ESLs) and e-commerce mean prices are now programmable at scale. Retailers that keep manual price-update processes are slow and costly; those who embrace programmatic pricing can update hundreds of SKUs many times a day. Examples from grocery and quick-service restaurants show experimentation with frequent price updates and targeted time-of-day pricing. The Wall Street Journal

How Algorithmic Pricing Outperforms Static Lists

Algorithmic pricing is not a magic wand — it’s a new operating model that replaces rigidity with rules, data, and closed-loop measurement. Here’s how it beats static approaches:

Figure 2: Algorithmic Pricing Beats Static Lists

Faster reaction to cost and demand signals. When commodity or transportation costs change, an automated engine updates recommended prices across affected SKUs to protect margins or recovery targets. This preserves profitability without manual intervention. (See Rocky Mountain Chocolate Factory’s example of frequent, data-driven price adjustments in response to cocoa costs.) The Wall Street Journal

Granular competitor response. Algorithms can monitor competitor price feeds and trigger competitive responses only when it matters (e.g., price gap on high-elasticity SKUs), avoiding pointless margin erosion.

Inventory-aware decisions. Pricing can be used as a control lever for inventory: raise price to slow demand on scarce items, or discount dynamically to clear near-expiry or overstock items. European grocers are using ESLs to discount near-expiry goods through the day to reduce waste — an operational use case enabled by dynamic pricing. The Wall Street Journal

Segmented and personalized pricing/offers. With privacy-compliant customer signals, pricing engines can craft bundles and personalized promotions that static calendars can’t manage at scale.

Automated experiments and learning. Algorithms can safely A/B test price points, learn elasticities, and converge to locally optimal prices — something manual schedules seldom do.

For industries that already embrace dynamic pricing (ride hailing, airlines, lodging), automated approaches have become core profit drivers; the same principles are increasingly applicable and practical for retail. Forbes

Real Examples

Transport & mobility: Uber’s surge pricing dynamically matches supply/demand in real time; the model is often cited as the archetype for demand-based dynamic pricing. Forbes

Grocery/ESL pilots: REMA 1000 and other chains in Europe are using electronic shelf labels to change prices multiple times per day (primarily to discount and reduce waste), showing the hardware + software stack that enables retail dynamism. The Wall Street Journal

Restaurants & QSR pilots: Some quick-service chains have begun testing time-of-day or demand-based menu pricing using digital menu boards; this shows real adoption outside classic travel sectors. The Guardian

Product cost response: Smaller retail brands (e.g., specialty chocolate makers) have moved to scheduled, data-driven pricing adjustments to offset commodity cost pressure while preserving margins. The Wall Street Journal

Market Insight

Adoption is accelerating in 2024–2025. Analysts and vendors report growing adoption as compute, data pipelines, and label/display tech mature; some vendors estimate rapid expansion into CPG and grocery categories where margins and waste sensitivity make dynamic approaches attractive. Vendavo

Consumer trust & regulatory risk. Frequent price changes can trigger backlash if perceived as exploitative. Best practice is transparent guardrails (no surge on essentials during crises), visible discounting strategies, and audit trails. Pilots that emphasize customer benefit (better fresh food pricing, targeted savings) mitigate the reputation risk. The Wall Street Journal

Operational readiness matters. Pricing engines require clean product data, reliable competitor signals, inventory linkages, and a governance layer (rules, price floors, and overrides). This is why most leading adopters run hybrid approaches — algorithmic recommendations plus human oversight during rollout.

Figure 3: Implementing Dynamic Pricing Successfully

How Rapidpricer — From Static To Algorithmic

A staged, low-risk migration reduces disruption and builds internal trust. Here’s a suggested roadmap RapidPricer can implement with retailers:

Assess & clean data (Week 0–4): Audit SKUs, cost inputs, competitor feeds, inventory links and sales history. Create canonical product IDs and surface data gaps.

Metric & objective definition (Week 2–6): Define objectives per category: margin protection, revenue lift, inventory turn, waste reduction. Set hard constraints (price floors, MAP, legal rules).

Pilot: recommendation-only mode (Weeks 6–12): Run algorithmic recommendations on a small category or store cohort but do not push prices automatically. Deliver recommendations to pricing managers and collect feedback and KPI delta.

Closed-loop A/B experiments (Months 3–6): Use controlled experiments to measure elasticity and validate revenue/margin outcomes. Iterate models (seasonal, price sensitivity per segment).

Selective automation with guardrails (Months 6–9): Automate price updates on low-risk SKUs (e.g., perishables near expiry, markup heuristics) with automated rollback and human override.

Scale with policy orchestration & auditing (Months 9–18): Expand automation, integrate with ESLs and POS, implement governance dashboards, compliance logs, and consumer transparency notices.

Continuous learning & optimization: Embed pricing as a continuous cycle: new features for competitor intelligence, promotional coordination, supplier cost pass-throughs, and downstream assortment decisions.

RapidPricer’s differentiators to emphasize in migration: simple visualization of price impact, a “recommendation first” safe mode, prebuilt connectors for competitor monitoring and ESLs/POS systems, and an explainability layer so merchant teams can see why a price was suggested.

Practical Guardrails and Governance

Set category rules: essentials vs discretionary — stricter controls on staples.

Define price floors (cost+minimum margin) and price elasticity thresholds.

Implement time-bound automation (only operate during preapproved windows) and manual overrides for events (e.g., local outages).

Keep a consumer communications plan: when dynamic pricing will benefit shoppers (e.g., discounts, fresher goods) and when it won’t.

Conclusion

Static pricing strategies (cost-plus, fixed lists, EDLP) still make sense in specific contexts — simple assortments, tight brand positioning, or when operational simplicity is paramount. But the 2025 retail landscape rewards responsiveness: volatile costs, intense competition, real-time channels and empowered consumers tilt the balance toward algorithmic pricing. Dynamic pricing — when implemented with sound objectives, governance, and customer sensitivity — turns price from a static ledger line into an active lever that protects margins, clears inventory, and increases relevance.

Platforms like RapidPricer offer a pragmatic path: start with recommendations, prove value through experiments, then scale automation with guardrails. The future of retail pricing isn’t “price whenever”; it’s “price smarter, faster, and kinder” — aligning commercial objectives with consumer value in real time.

"AI-Generated Content Disclaimer

This content was generated in part with the assistance of artificial intelligence tools. While efforts have been made to review, edit, and ensure the accuracy, completeness, and reliability of the content, it may still contain errors or omissions. It should not be considered professional advice, and users should independently verify any information before making decisions based on it. The publisher/author assumes no responsibility or liability for any consequences resulting from reliance on this content."

Read More On

Holiday 2025 Pricing Playbook: How Retailers Should Plan for Q4

Micro-Zone Pricing: The Next Evolution in Retail Personalization

The Future of Retail Pricing: Humans, AI, and the Art of Strategic Decisions

Forecasting Without a Crystal Ball: How AI Complements Human Insight

Fairness Meets Profit: Designing Ethical Dynamic Pricing Systems

About RapidPricer

RapidPricer helps automate pricing and promotions for retailers. The company has capabilities in retail pricing, artificial intelligence, and deep learning to compute merchandising actions for real-time execution in a retail environment.

Contact info:

Website: https://www.rapidpricer.com/

Email: info@rapidpricer.nl

Comments